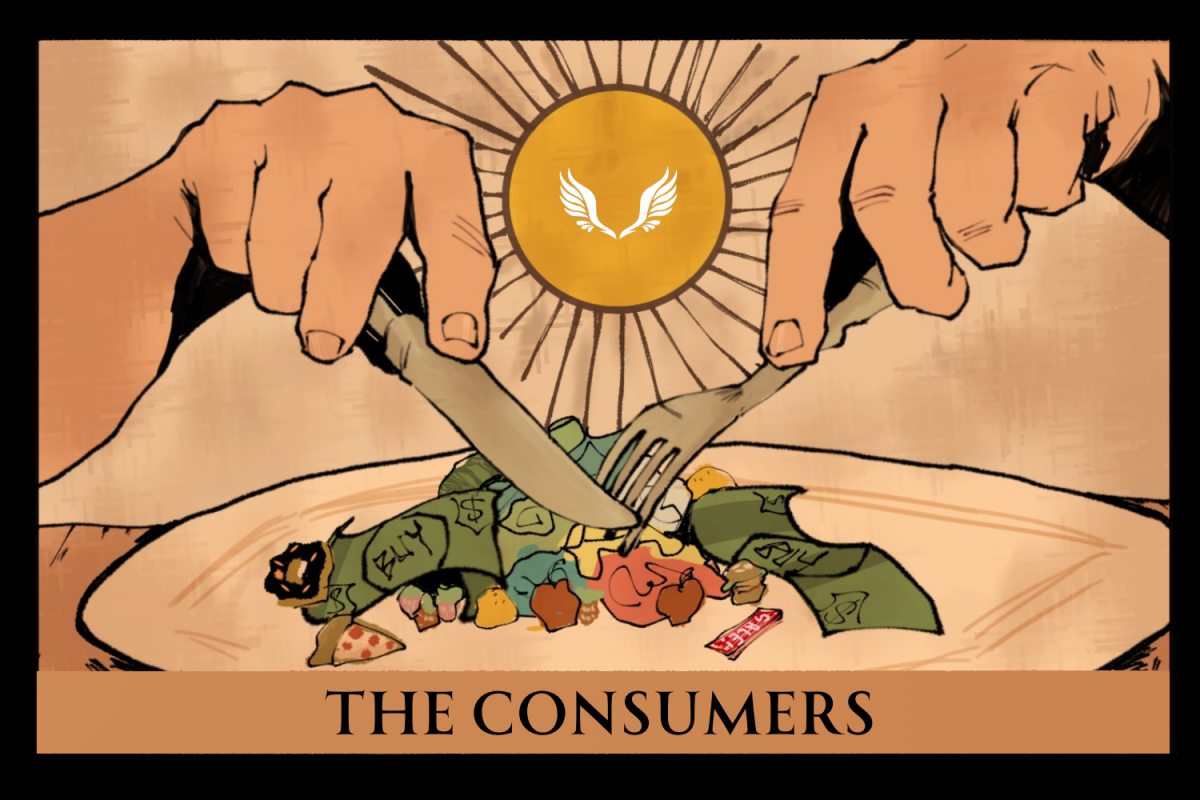

The stock market is a crazy, wild landscape of investors searching for the best way to maximize their capital. It takes an experienced investor to be able to navigate the millions of stocks available, all of which change by the smallest of percentages every second of the day.

From an outside perspective, the stock exchange seems to be a daunting and unforgiving place for anyone who doesn’t understand how it works. Less experienced traders can easily get lost in the commotion, but problems arise when less experienced investors band together to disrupt major players in the stock market. In short, that is what happened with Gamestop’s last week.

In recent months, Wall Street has been flooded with amateur investors (often nicknamed “armchair traders”) looking to make a quick buck in any way possible. That has occurred for a number of reasons, most of which sprouting from the COVID-19 pandemic. In regards to armchair traders, the New York Times states, “…some smelled opportunity after stocks tumbled last spring, some were trying to scratch a gambling itch when sports leagues shut down, and for some it’s just a game – trying to ring up dollars instead of points.”

Free platforms like Robinhood have also made it easier for anyone with internet access to trade stocks, which has added to the amount of amateur investors in the market. When operating on their own, they are constantly pushed around in the ever-changing landscape of the market. Forums like Reddit’s r/WallStreetBets stand as a hub for people to share memes, discuss trades, and recently, to coordinate attacks against major hedge funds on Wall Street.

According to The Balance, “A hedge fund is often a limited partnership or LLC that pools money from investors to invest in securities or other higher-risk options.” A hedge fund is a vehicle for investing, rather than an actual form of investment itself. Not just anyone can join one though. They are limited to wealthy investors who must meet strict financial requirements in order to qualify to become a part of one.

By those standards, it doesn’t look like you’re going to find many Davie County residents that are a part of major hedge funds like Bridgewater Associates and Renaissance Technologies. Hedge funds have a major influence on the stock of any particular company, which has made them a target for armchair traders on r/WallStreetBets.

A few major hedge funds have been “shorting” Gamestop recently. Simply put, shorting a company means that they expect Gamestop to decrease their stock price in the future. If done correctly, an investor can profit from the decrease in stock. I’ll try to explain it as simply as possible.

Shorting a company involves borrowing a portion of their stock from a broker (someone who manages the buying and selling of shares). An investor borrows that stock and sells it to someone else under the agreement that the investor will buy it back later. If they buy the stock back when the price is lower, then they take the difference as a profit for themselves. If they buy it back when the price is higher, they lose money. The goal is to sell it for a high price, and buy it back for a cheaper price.

For example, let’s say a woman named Sarah wants to short Gamestop. To do so, she borrows 10 stocks of the company (worth $10 per share) and sells it to a man named Derek. As a result, Sarah gets $100 for selling all 10 shares. Later, Gamestop’s stock drops to $7 per share. Sarah buys all 10 shares back from Derek at $7 per share, costing her $70. As a result, Sarah makes $30 from shorting Gamestop. On the flip side of that, if the price of Gamestop’s stock were to increase, then Sarah would have to buy the 10 shares back for a higher price than what she sold them for, causing her to lose money. The hedge fund Melvin Capital was attempting to do that with Gamestop’s stock until the traders on r/WallStreetBets drove the price up.

In late January, traders on r/WallStreetBets began driving up the price of Gamestop’s stock to strike a blow to the hedge funds shorting the company. They did that in two ways. The first and most obvious way is that some just bought up shares of the company. Others began placing bets directly against the short. To do so, those investors made what are known as options bets. An option bet is a contract stating that an investor has the option to buy a stock from a broker at a set price in the future. If the price goes up for that stock, then the investor can invoke their contract and get the stocks from the broker at the set price and sell them at the current, higher price.

Oftentimes, instead of invoking the contract, investors just buy and sell the contracts themselves. By agreeing to the contract, brokers are required to provide the shares to the investor if they ever invoke the contract. To minimize the risk, brokers oftentimes buy a portion of the stocks ahead of time while they are cheap so that they don’t have to buy a lot of expensive shares in the future.

Usually, the small amount of brokers buying stock to minimize risk does little to the demand of the stock itself. However, when the demand of a stock rises sharply or a lot of people get option bets, more brokers are forced to buy shares. If the brokers don’t buy shares, then they run the risk of having to buy a lot of expensive shares when someone uses their contract. With more brokers buying more shares, the demand goes up. That increase in demand forces more brokers to buy shares, which makes demand go up even more, so on and so forth.

That massive chain reaction is essentially what drove up Gamestop’s stock by nearly 3000%. That surge managed to temporarily skyrocket Gamestop’s value by $10 billion! On January 28th, their stock peaked at $483 per share. The key word there is temporarily. As of February 4th, the price per share is $54, which is close to the price of the stock before the chaos ensued. The graph below illustrates how the stock rose and fell.

As a result of Gamestop’s rise and fall, hedge funds like Melvin Capital took a near-fatal blow. Melvin Capital required a $2.75 billion cash injection just to stay afloat after their short failed miserably. The traders at r/WallStreetBets aren’t done though. Investors began driving up stock prices for other companies like AMC Entertainment, American Airlines, and BlackBerry in order to strike out against other hedge funds. Many are quoting the Joker from The Dark Knight, stating, “It’s not about the money, it’s about sending a message.”

The “armchair trader rebellion,” as I like to call it, could have disastrous effects on the stock market. With stocks rising and falling so rapidly in various companies, it could force wealthy, more experienced investors to reallocate their shares in order to cover their losses. Stocks that seem stable for now could end up dramatically declining in the near future. With so many prices rising and falling in a trading frenzy, it begs the question: “What’s next?”